NCD vs Fixed Deposit: Which Is a Better Investment Option?

08 November, 2025 NCD

4 mins read

If you're looking for safe and stable ways to grow your money, you’ve likely come across two popular choices — NCD (Non-Convertible Debentures) and Fixed Deposits (FDs). Both are low-risk investment options, but which one is truly better for you?

Let’s break it down in simple terms and help you decide the best path for your financial goals in 2025.

What Is a Fixed Deposit (FD)?

A Fixed Deposit is a savings tool offered by banks and financial institutions where you lock in your money for a specific period and earn fixed interest. The returns don’t change during the deposit term, making it one of the safest investment options in India.

FDs are especially popular among senior citizens and conservative investors because they are low-risk and offer predictable earnings.

What Is an NCD (Non-Convertible Debenture)?

An NCD, or Non-Convertible Debenture, is a type of loan you give to a company for a fixed time in return for regular interest. Unlike FDs, NCDs are tradable in the stock market, meaning you can sell them before maturity.

There are two types:

- Secured NCDs – Backed by company assets (safer)

- Unsecured NCDs – Not backed by any asset (riskier)

If you're looking for higher returns than FDs, NCDs may seem attractive. However, the risk in NCD vs FD is higher due to the market-linked nature of NCDs.

NCD vs Fixed Deposit: Key Differences

Here’s a quick comparison of NCD vs Fixed Deposit to help you understand the core differences:

|

Feature |

Fixed Deposit (FD) |

Non-Convertible Debenture (NCD) |

|---|---|---|

|

Returns |

5% – 7% (fixed) |

8% – 10% (varies by issuer) |

|

Safety |

Very High (bank insured) |

Depends on issuer’s credit rating |

|

Liquidity |

Low |

High (can be traded) |

|

Tenure |

Flexible |

Usually 1–10 years |

|

Taxation |

Interest is taxable |

Interest is taxable |

So, which is safer: NCD or FD? The answer depends on your risk appetite. FDs are better for safety. NCDs are better for returns.

Returns: Is NCD Better Than FD in 2025?

If your goal is to maximize returns, NCDs might give you better results. For instance, some top-rated NCDs offer up to 10% annual interest, while most FDs offer around 6–7%.

However, FD vs NCD returns should not be the only deciding factor. You should also consider:

- Your income needs

- Investment duration

- Risk tolerance

Risk and Safety: Which One Should You Trust?

When it comes to safe investment options in India, FDs are preferred due to their guaranteed returns and backing by deposit insurance. NCDs, on the other hand, carry credit risk — you must check the credit rating of the issuer.

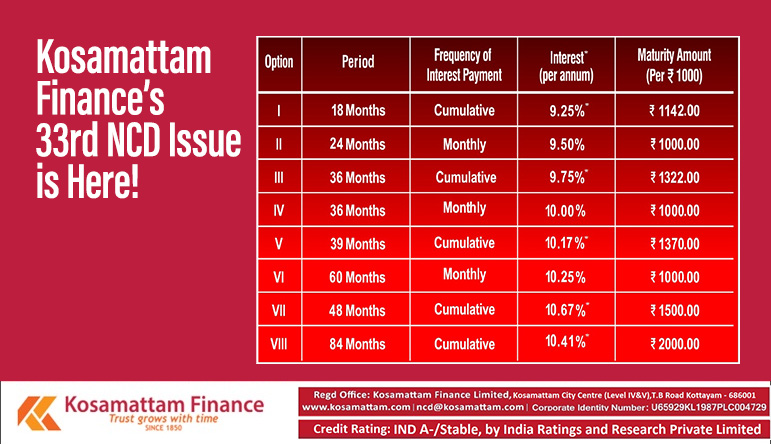

A secured NCD from a well-known NBFC like Kosamattam Finance can be a better choice if you want slightly higher returns without taking too much risk. They have a track record of offering reliable NCD investment benefits.

NCD vs FD for Senior Citizens

Senior citizens generally prefer FDs due to:

- Additional interest rates (up to 0.5% extra)

- Stable income

- Low risk

But some conservative NCDs also offer monthly or annual interest payouts, making them an option for retirees seeking better income. Still, NCD vs FD for senior citizens should be evaluated based on health, age, and income needs.

Taxation on NCD vs FD

Both NCD and FD interest is taxable as per your income slab. However:

- In FDs, tax is deducted at source (TDS) above ₹40,000 (₹50,000 for seniors)

- In NCDs, tax is also applicable, but gains from selling NCDs early may fall under capital gains tax

So, in terms of FD vs NCD tax, both are quite similar, but proper planning can reduce your tax burden.

How to Invest in NCDs and FDs in India?

Fixed Deposit

You can open an FD with:

- Banks (public/private)

- Post office

- NBFCs like Kosamattam Finance

NCD

You can invest in NCDs through:

- Demat accounts during public issues

- Stock exchanges for listed NCDs

- NBFC websites and financial advisors

Before investing, check the credit rating and company performance.

Conclusion: NCD vs Fixed Deposit – Which Is Better?

To sum it up:

- Choose FDs if you want complete safety and peace of mind

- Choose NCDs if you want higher returns and can handle a bit more risk

- Diversify — don’t put all your money in one basket

In 2025, with rising inflation and market changes, both NCD and Fixed Deposit can play an important role in your portfolio. Consider your age, income, financial goals, and risk tolerance before making a decision.

For those who are looking for a balanced and trusted NBFC, you can explore investment options with Kosamattam Finance, which offers both secure NCDs and deposit plans with competitive interest rates.

FAQs:

1. Is NCD better than FD for short-term investments?

Not always. FDs offer more flexibility for short terms.

2. Can I break my NCD like an FD?

No. But you can sell listed NCDs in the market.

3. What is the minimum amount to invest in NCDs?

It’s usually ₹10,000, but varies by issuer.